New customer transaction data-driven solution enables banks to show customers their carbon footprint and suggests ways to reduce emissions with greener spending choices and climate-friendly financial goals

NEW YORK & TEL AVIV -- (BUSINESS WIRE) -- Personetics, the leading global provider of financial data-driven personalization, customer engagement, and advanced money management capabilities for financial institutions, today announces the launch of Sustainability Insights. This new offering, included within the Personetics engagement platform, will help banks meet growing customer demand and regulatory expectations for environmentally responsible banking and sustainable finance. Personetics is partnering with industry-leading impact fintech ecolytiq, whose Sustainability-as-a-Service® solution enhances the data models of Sustainability Insights, making them more precise, personalized, and actionable.

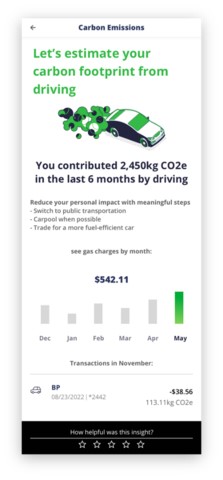

The Personetics Sustainability Insights solution is the world’s first to show banking customers the carbon footprint of every banking transaction and recommend personalized actions to reduce carbon emissions – such as by making purchases from lower-carbon merchants or categories or saving for climate-friendly financial goals. Sustainability Insights are fully embedded into the Personetics financial data-driven engagement platform, based on advanced data analytics of billions of customer transactions.

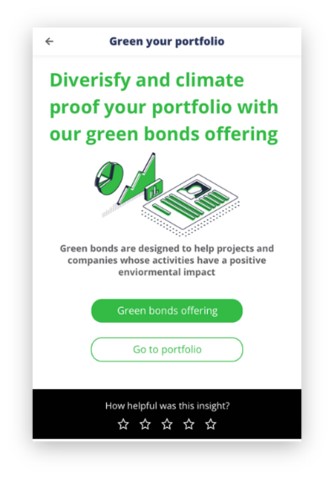

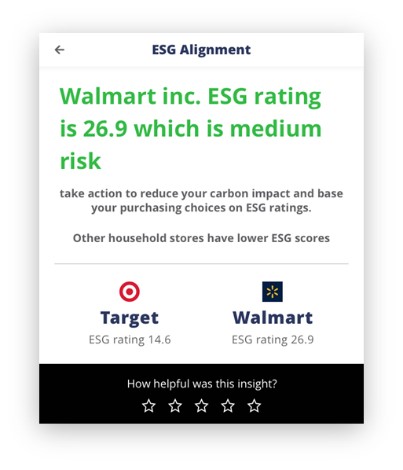

Beyond just tracking carbon emissions and showing customers their personal carbon footprint, Sustainability Insights is a complete integrated approach that also assesses other factors, such as overall ESG company information to further calculate the individual impact. It also enables banks to recommend their own existing products which may help a customer take more sustainable financial decisions.

Sustainability Insights is based on Personetics’ four pillars of sustainable finance strategy:

- Integrated: The Sustainability Insights are fully integrated into the existing financial data-driven engagement platform and accessible within each participating financial institution’s digital channels; customers can now see their carbon footprint and receive recommendations within their bank’s mobile app.

- Relatable: Sustainability Insights are based on each customer’s own financial transaction data. People can see the carbon emissions of their everyday spending decisions – and get advice on how to reduce carbon emissions with their financial choices.

- Interactive: Sustainability Insights are easy to understand and engaging for banking customers, with an easy-to-use digital banking user experience.

- Actionable: Customers can quickly take action to reduce their carbon emissions, such as by opening a savings account to save money for solar panels or an electric vehicle or deciding to purchase a different product or shop at a more climate-friendly store.

Key capabilities of the Sustainability Insights offering include:

- Providing a personalized, holistic financial map that visually demonstrates the carbon emissions of customer spending or investments.

- Giving customers the ability to take action to reduce their carbon emissions with personalized insights and advice, depending on their financial situation. For example, the solution might suggest alternative merchants that are more carbon friendly, suggest a savings goal for installing solar panels, offer green investment products, or allow a customer to set a carbon target and track their progress through their spending.

- Personalization and Engagement: Actively engaging with the user to increase the accuracy of the insights via quizzes and feedback insights.

To provide banking customers with the most precise, and actionable climate impact data, Personetics has integrated ecolytiq's country level models with its own proprietary capabilities. ecolytiq provides financial institutions with country-specific data sources and models to help them achieve best-in-class carbon impact calculations.

For increased depth of data, Personetics’ Sustainability Insights also partners with additional global providers of carbon emission research to offer various merchants footprint or spending categories within specific countries.

Personetics’ Sustainability Insights will empower financial institutions to be leaders in environmentally responsible banking and will help customers take action to choose a more sustainable lifestyle with better-informed financial choices. Data from Deloitte shows 28% of consumers have already stopped purchasing certain brands or products due to sustainable or ethical concerns, and dozens of the world’s banks are already committing to change through the UN’s Principles for Responsible Banking.

Banks will also be able to feed insights from the Personetics platform into their ESG reporting by tracking and measuring the actions customers are taking to reduce their carbon footprint. This can help financial institutions demonstrate significant leadership in supporting their customers while fighting climate change.

David Sosna, CEO of Personetics, said:

“We are excited to launch our new Sustainability Insights, backed by the industry-leading data sources of our partner ecolytiq. Personetics Sustainability Insights are the next evolution of sustainable finance – beyond just showing bank customers their carbon footprint, we offer them specific actions that they can take today to reduce their carbon impact, choose climate-friendly savings goals, and push the industry in a greener direction.

“Sustainability Insights also drive business impact for financial institutions by improving customer engagement, creating new occasions for targeted cross-selling, and recommending specific banking products and new accounts in a way that is personalized for each customer’s financial situation and future goals. This will create deeper relationships with banking customers and ultimately support banks’ ESG reporting. Every financial institution can be a leader in green banking with Sustainability Insights.”

Ulrich Pietsch, CEO, ecolytiq said:

“The financial industry will play a major role in fighting climate change. This starts by providing people with the information they need to make greener decisions. Banks that act now by embracing sustainability will be the first to reap its benefits for years to come. By partnering with Personetics, we’re excited to be able to help even more financial institutions across the world with in-depth data about their customers’ carbon footprint, so they can suggest actions to improve it.”

The new Sustainability Insights offering is now available on the Personetics platform and is ready to be activated by Personetics’ existing global network of 80 financial institutions with a combined reach of 120 million bank customers.

About Personetics:

Personetics is the global leader in financial data-driven personalization, customer engagement, and advanced money management capabilities for financial services. We are creating the future of “Self-Driving Finance,” where banks can proactively act on their customers’ behalf to help improve their financial wellness and achieve financial goals.

Our industry-leading data analytics solutions harness customer financial transaction data to provide day-to-day actionable insights, personalized recommendations, product-based financial advice, and automated financial wellness programs. We offer solutions for mass market consumer banking, SMB banking, wealth management, and credit card issuers.

We drive business impact for financial institutions by improving relevant product targeting for accurate, efficient cross-selling and upselling. We help financial institutions deepen their customer relationships, increase core deposits and customer retention, expand share of wallet, and boost Customer Lifetime Value.

Personetics currently serves over 80 financial institutions spanning 30 global markets, reaching 120 million customers. We are backed by leading venture capital and private equity investors, with offices in New York, London, Tel Aviv, Singapore, Rio de Janeiro, Tokyo, Paris, Madrid, and Sydney. Learn more at personetics.com

About ecolytiq:

The Sustainability-as-a-Service® solution from ecolytiq enables banks, fintech companies and financial service providers to show their customers the individual impact their purchasing behavior is having on the environment in real time. The ecolytiq software calculates personal environmental impacts, such as CO2 values, on the basis of payment transactions and educates consumers on sustainable spending habits through climate insights. Learn more at www.ecolytiq.com

CONTACT:

Media inquiries

Toby Earnshaw / Aimee Cashmore

personetics@pancomm.com

Michal Milgalter, Head of Global Marketing

Michal.milgalter@personetics.com

Media contact ecolytiq:

Yuki Hayashi I ecolytiq GmbH I media@ecolytiq.com

phone: +49 30 2201232-80

Examples of Personetics’ sustainability capabilities (Graphic: Business Wire)

Examples of Personetics’ sustainability capabilities (Graphic: Business Wire)

Examples of Personetics’ sustainability capabilities (Graphic: Business Wire)